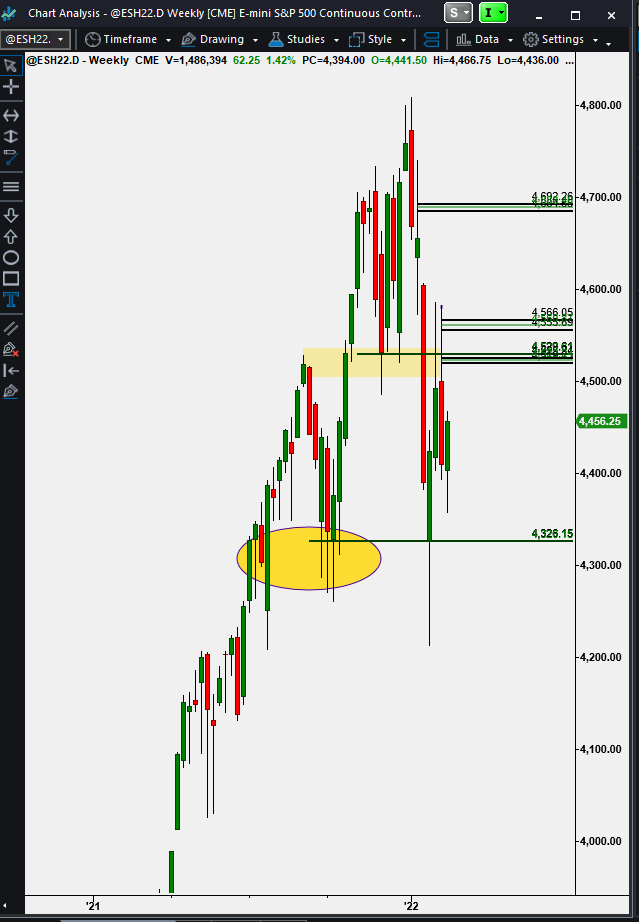

LOWS BREAK, VIX SPIKING - LOOK OUT BELOW? ~ February 23, 2022

Hey all, I wanted to get out a few charts looking at higher time frames to get an idea of what's going on and what may happen next. First of all, the lows we've talked about the last few weeks that have held up - well, they no longer are holding. Both $ES and $NQ lows have broke - see below $MES/$ES Daily Chart - lows breaking $MNQ/$NQ Daily Chart - lows breaking Taking a look at the weekly charts, you can clearly see we have broke the recent lows, both tagging the levels (indicated by the wicks on candles) and now the last couple sessions closing below the recent lows. We've clearly set highs, broke down through the last line in the sand for buyers (demand zone ~$4560s), attempted to rally back to the highs/levels where prices broke down, but couldn't hold. This to me looks like we are in for more downside to come - at least in the short term. We'll see what happens now till the Fed's March meeting in 3 weeks when rates are supposed to rise(they alread