Hold-Bounce-Fail-Retest-Fail-Hold...? - February, 15, 2022

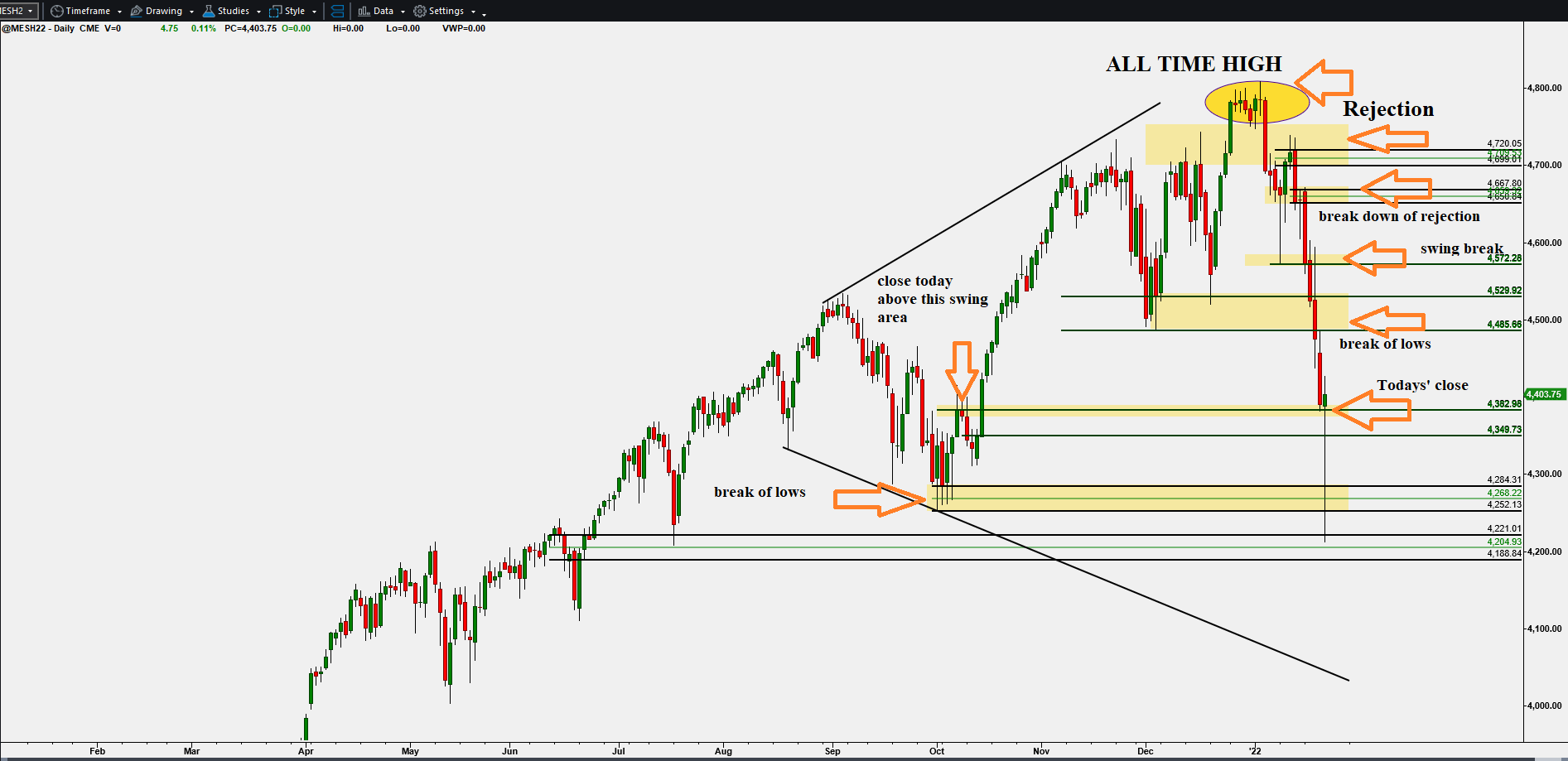

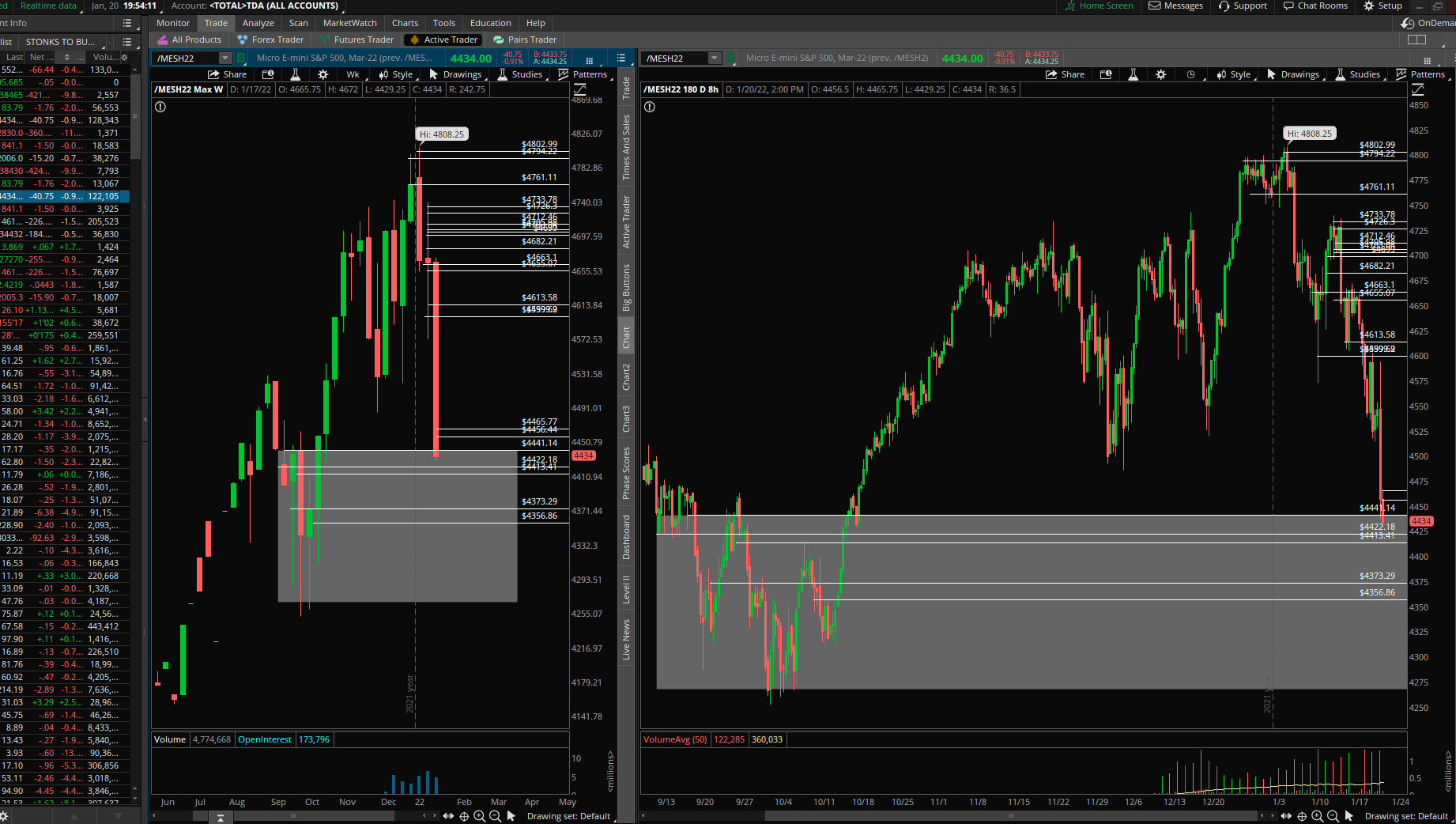

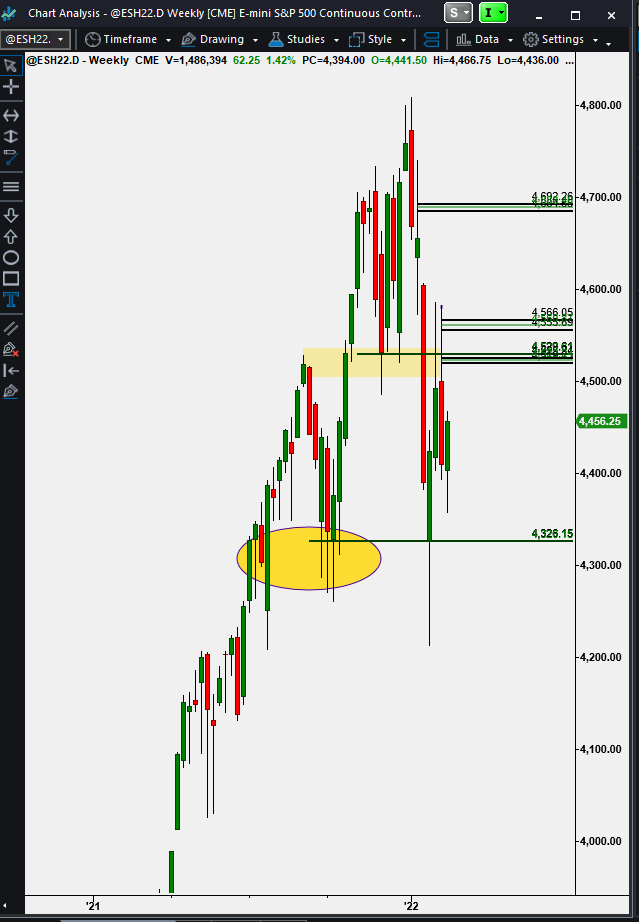

What Next? Hey guys, just wanted to give an update to the broader markets again, specifically the $MES/$ES and $MNQ/$NQ. Over the last several weeks we talked about the S&P needing to hold a previous weekly/daily swing low area from last October (2021). * see below* $ES/$MES Weekly Cash Session Chart So.... we held that level - then bounced - then failed $4550s-$4600 - retested that area - failed again... As you can see from the chart above, we currently are holding the $4300s most recent swing low. So, if we can hold these levels and set a higher low the markets should continue to bounce for a potential takeout and clearing of +$4600s. We can also see this price action happening on the $MNQ/$NQ futures contract as well. *see below* $MNQ Daily Chart - Possible higher low forming For the $MNQ/$NQ we want to see the $14000s hold and this possible higher low forming on the daily chart to complete and get a move above $15200s. We will see how the rest of the week plays out, but