Where Are We Now? FED Rate Hike This Week - March 15, 2022

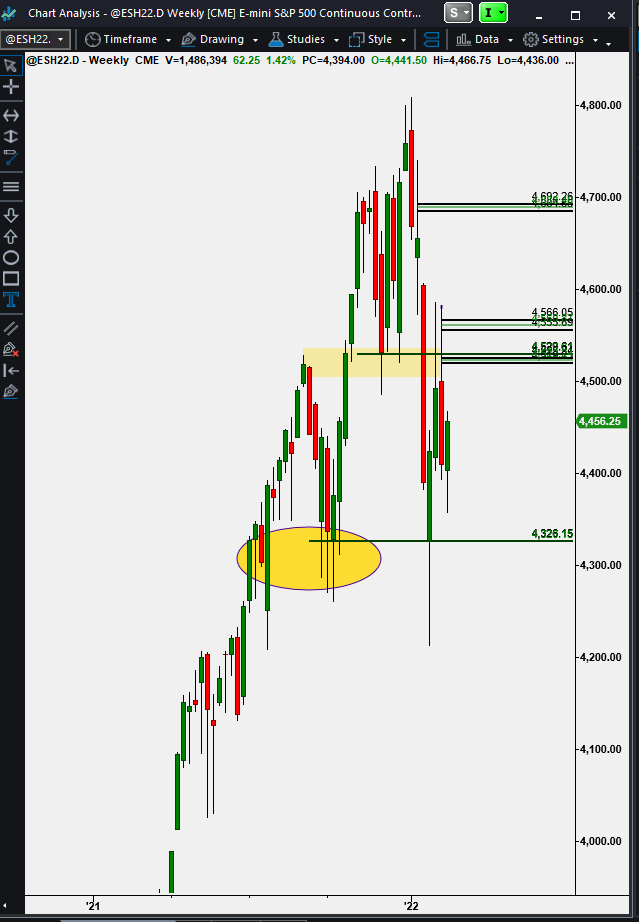

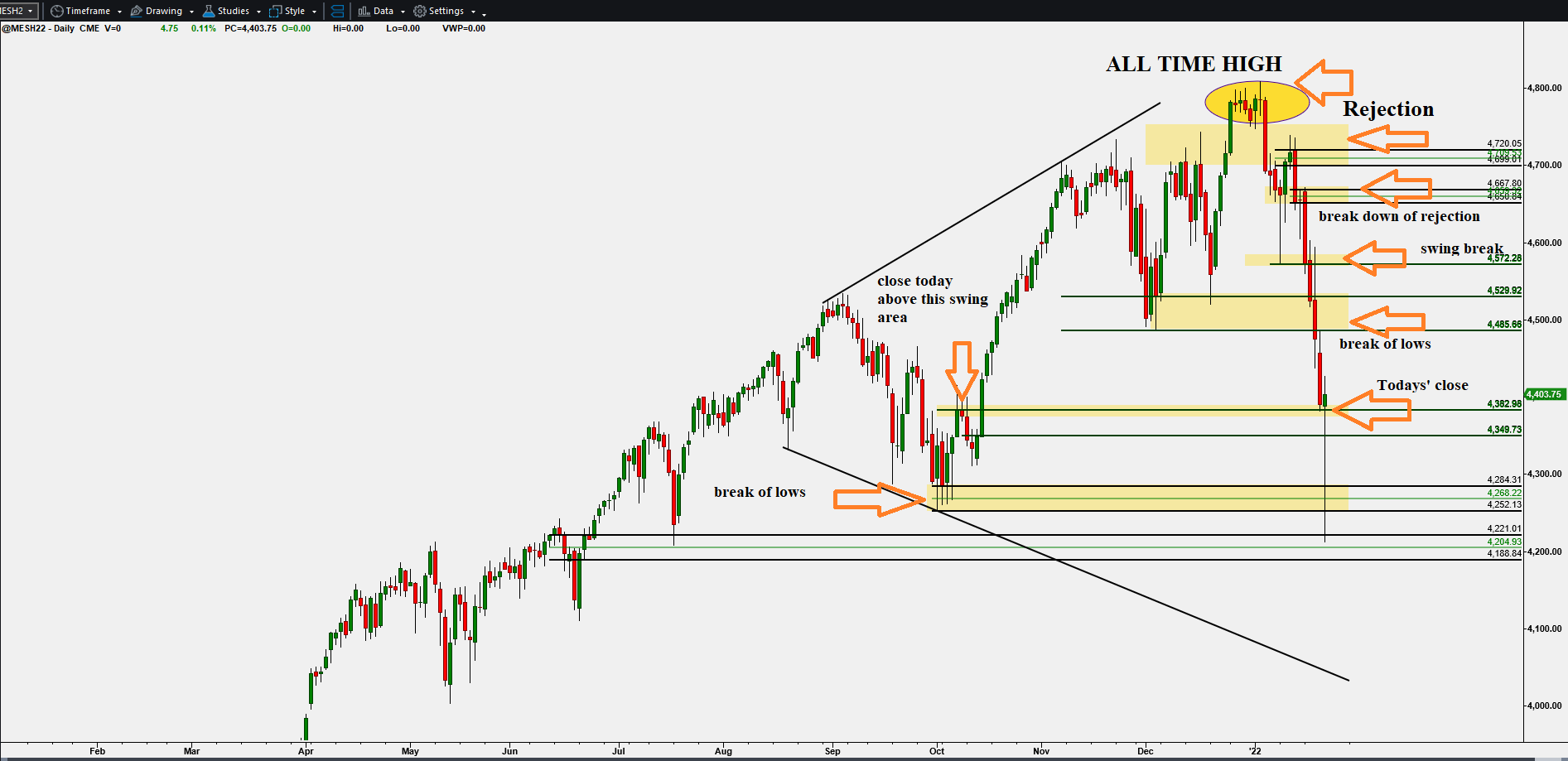

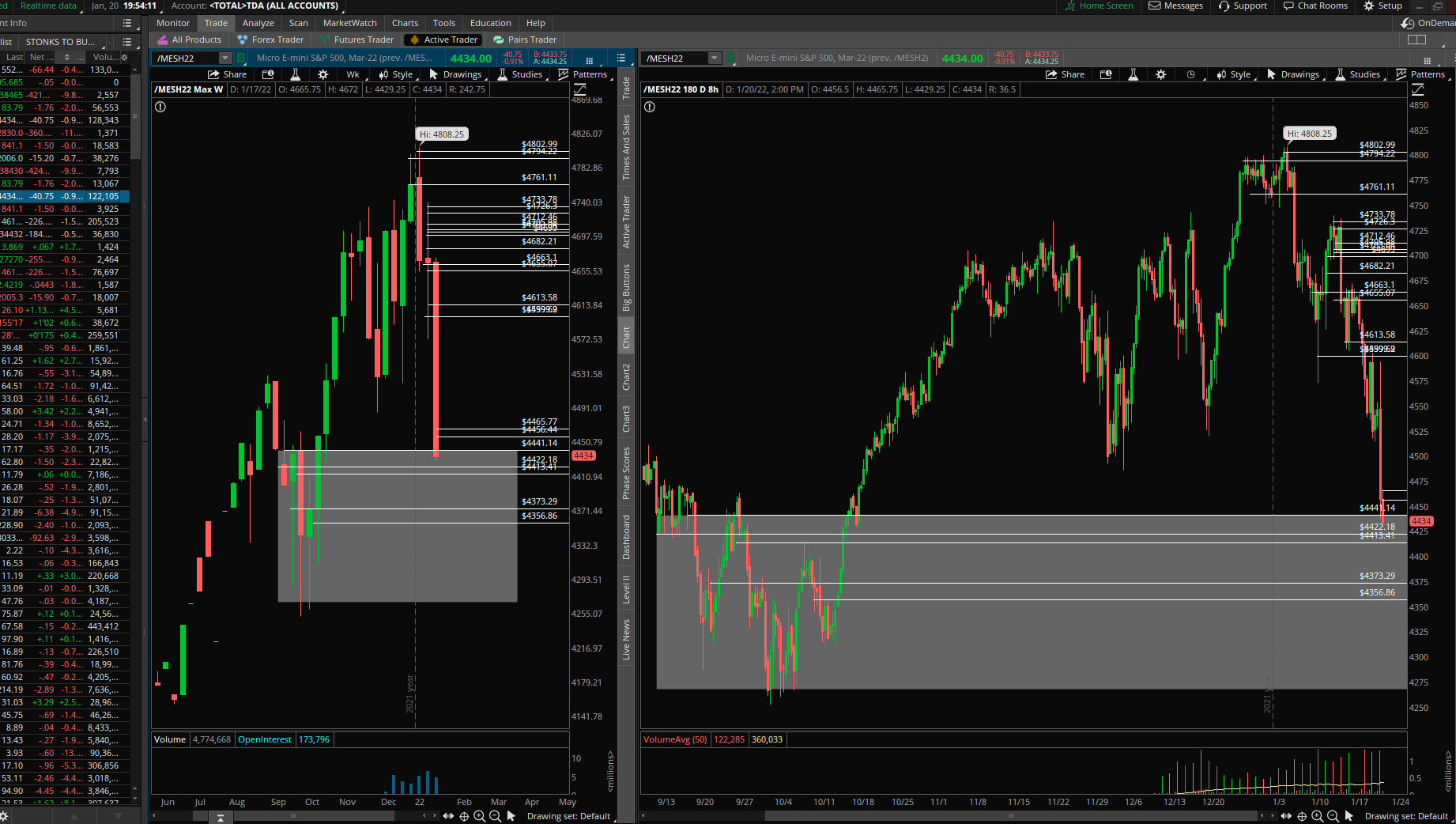

Update On Markets~ FED Rate Decision Tomorrow Since our last post, the markets have continued to trade lower, albeit not in too much of a hurry from a larger time frame perspective (intraday moves have been wild in a lot of markets). With the FED set to raise rates tomorrow, it'll be interesting to see what they say considering everything going on outside of the markets i.e., Ukraine/Russian War, inflation, spikes in commodities, and potentially headwinds regarding China. Anyway, charts I'm watching going into tomorrow's FED meeting: ^^^$ES/$MES Daily & 4hr charts. *Looking for a retest lower to ~$4200 before holding to bounce for a bullish close above $4250-$4300. ^^^ $NQ/$MNQ Daily & 4hr charts. -Same thing for Nasdaq, retest lower for a hold and bounce to close higher. ^^^$CL Daily chart - Crude is still something to watch with opportunities on both sides of the market, longs <$92 and shorts above $105s. $VIX Weekly & Dail